The Founder’s Fork: Navigating Vision, Unicorns, and the Scarcity of 2025

Audio narration of the article:

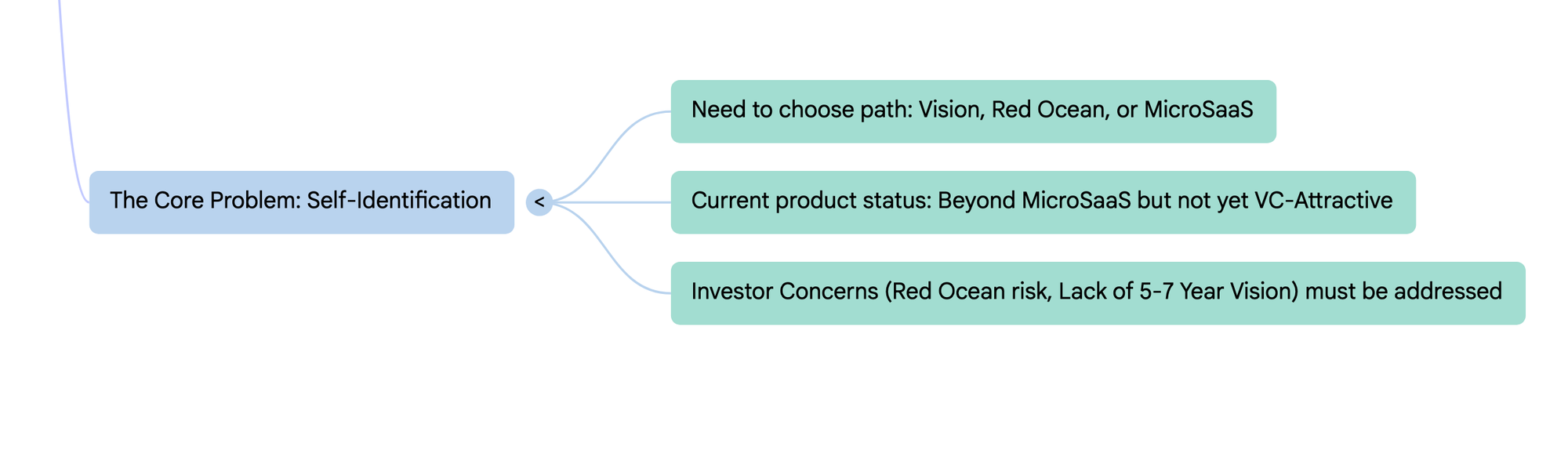

In the turbulent world of venture capital, founders often face a fundamental identity crisis: are they building the next trillion-dollar disruptor, or a highly profitable, sustainable MicroSaaS? For Alex Tartach, founder of CrossLike, this dilemma is immediate and crucial. Having navigated the post-COVID boom and subsequent crash, Tartach believes the current market (2025) demands immediate clarity.

“We have a problem with self-identification,” Tartach admits. “Our current efforts have outgrown the MicroSaaS category, but they have not yet scaled enough to be attractive as a venture-backed startup.”

We sat down with Tartach to discuss why the traditional paths to success—the five-year master plan and the early-mover advantage—are struggling to survive the current cycle.

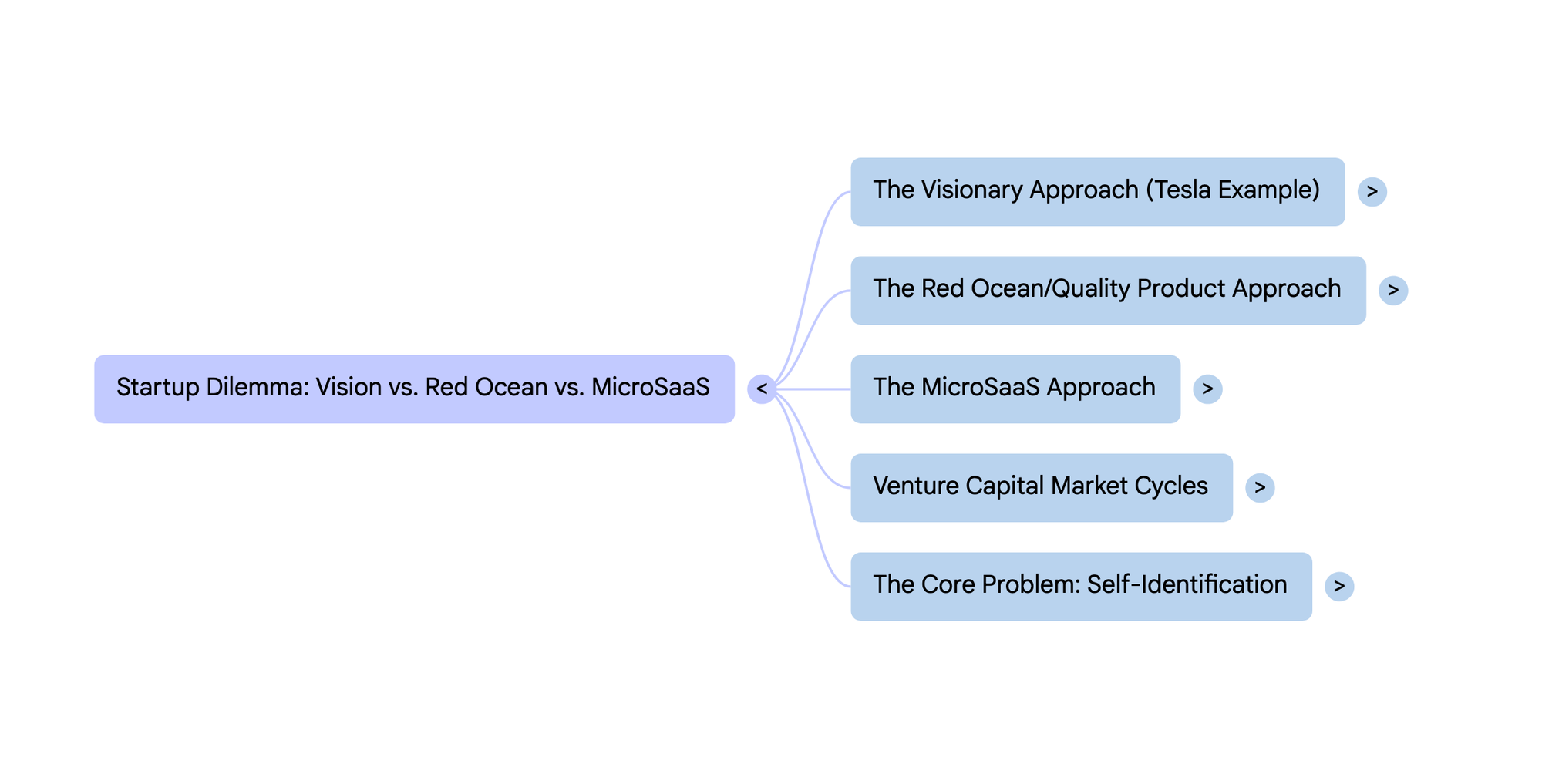

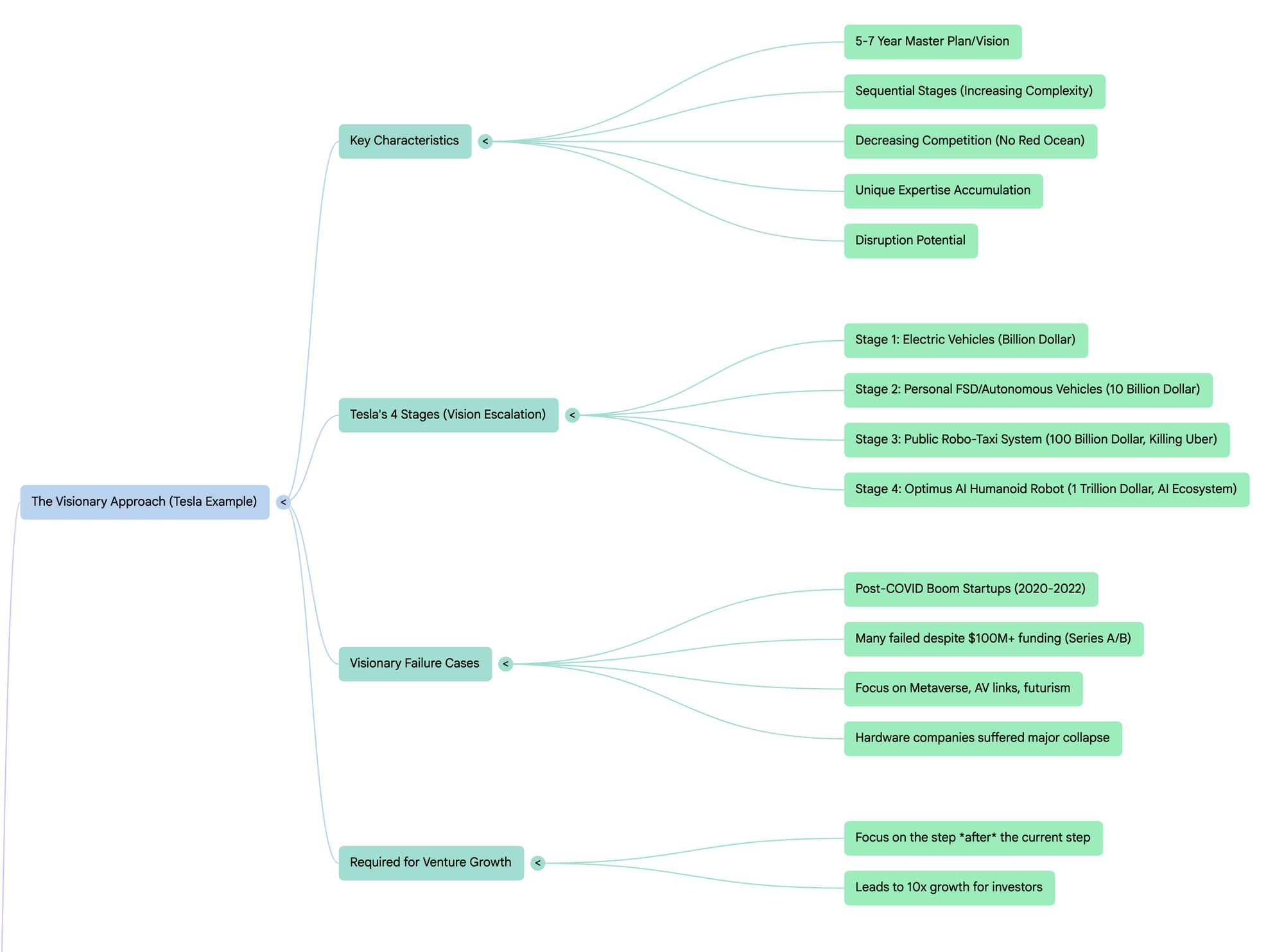

When Vision is Required: The Tesla Blueprint

For startups seeking exponential venture growth, Tartach argues that a comprehensive, long-term Vision is indispensable. This vision must extend far beyond the current product roadmap.

“A good example of such a five-to-seven-year master plan, a Vision, was actually Tesla’s when they were just starting to build something and how they attracted money,” Tartach explains.

Tesla’s strategy was to present subsequent stages, each becoming "more complex, more visionary, and less competitive". This structure ensures that as competitors catch up to Stage 1, the company is already building something unique in Stage 2, using specialized expertise accumulated from the previous stage.

Tartach defines this true visionary approach succinctly: "Vision is not what we are doing now, but what we will do after we finish what we are doing now". This plan must lead to territory where competition is absent, where "rocket science" begins, and where unique expertise is the only barrier to entry. This is how a company progresses from a potential billion-dollar valuation (Stage 1) to a projected trillion-dollar valuation (Stage 4, Optimus).

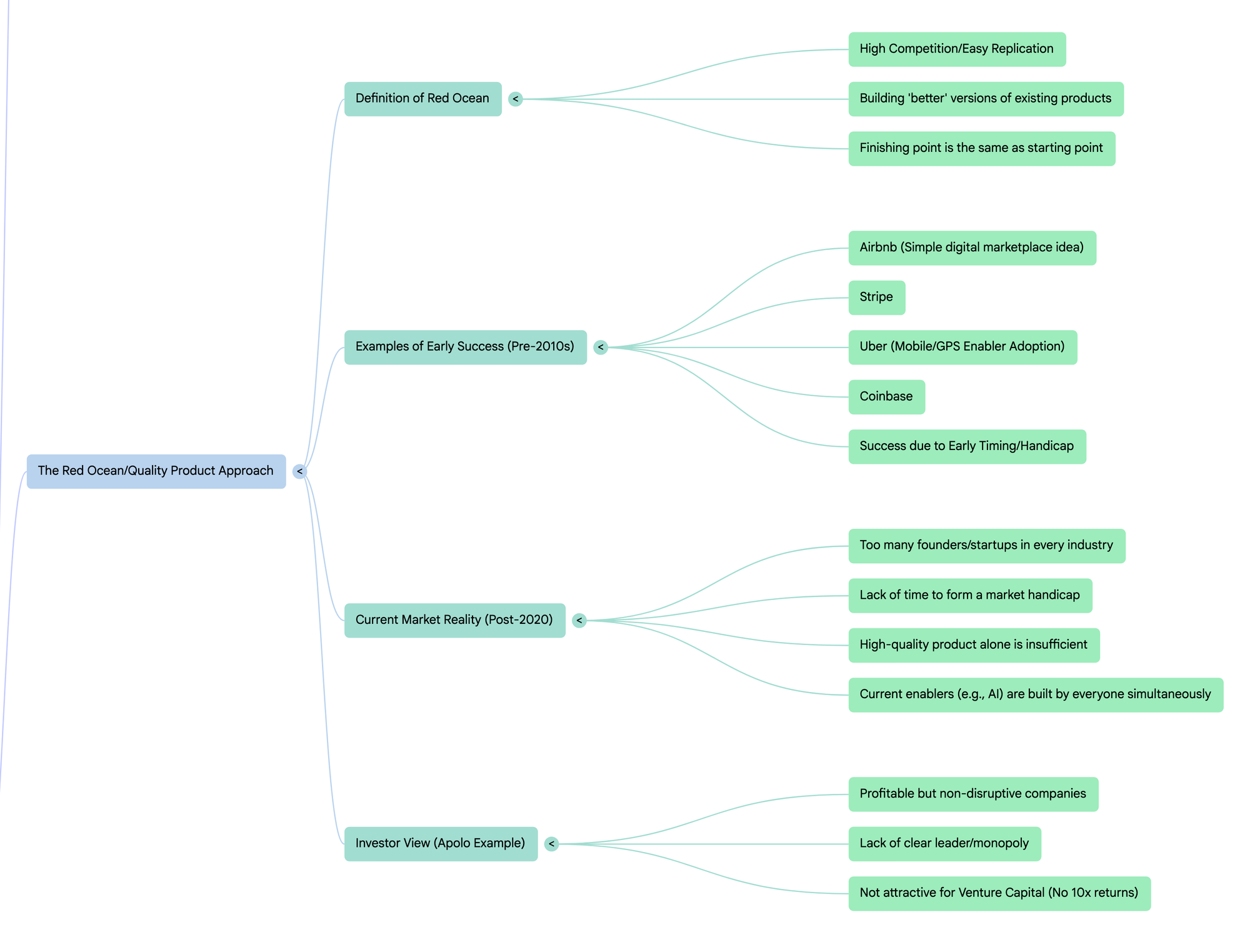

The Collapse of the "Handicap" Model

In contrast to the Tesla model, many successful multi-billion dollar companies—Uber, Stripe, Coinbase, Airbnb—succeeded simply by being early market entrants. They didn't need a multi-stage plan; they only needed impeccable timing.

“They made a simple product, and that same simple product remains, but they are still the number one market leader and a super-profitable company. The same goes for Stripe, the same for Uber,” Tartach notes. These companies gained a market "handicap" that later competitors, who emerged "much later," couldn't overcome.

However, this model is no longer viable in the "Red Ocean" of 2025. Today, market saturation means any obvious idea, even one utilizing new enablers like AI generation, is being built simultaneously by dozens of fast-moving competitors.

“We are saying at the current moment that we will build something that doesn't exist yet, but it is so superficially obvious that everyone else will build it in parallel with us, so by the time we finish building it, we will be in the same place we are now,” Tartach warns.

The VC Paradox: No One Wants to Invest Early

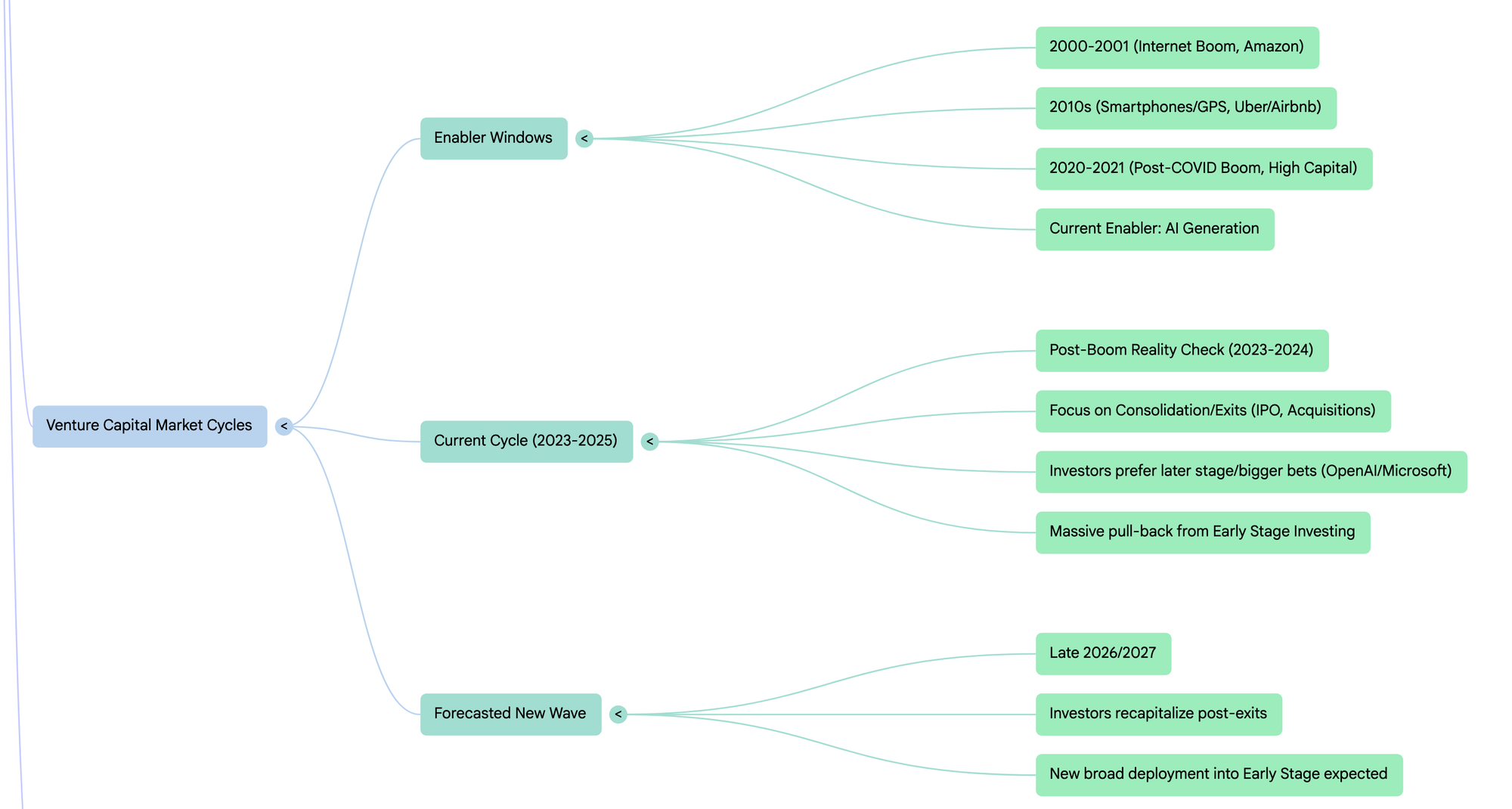

The necessity of a strong Vision is compounded by the harsh realities of the current venture cycle. Following the post-COVID boom (2020–2022), when investors poured money into nearly everything, many highly funded startups—even those with excellent visions and up to $100 million in Series A/B funding—went bankrupt or were acquired cheaply in 2023–2025.

“To my surprise, even startups that had a really cool long-term Vision, a view one, two, three, four steps ahead, have died off,” Tartach says.

This mass collapse has led to investor caution. The market is now focused on consolidation (acquisitions, mergers, IPOs), not mass deployment of early-stage capital. Tartach predicts that a new wave of broad early-stage investment won't likely return until late 2026 or 2027.

This creates a critical paradox for founders:

“No one wants to invest at the early stage; everyone wants to invest at the later stage. But how is a startup supposed to teleport to the later stage if none of you invest at the early stage? I don't understand this,” Tartach challenges.

If a startup manages to grow to the point where late-stage investors are interested without early funding, they likely won't need those investors at all.

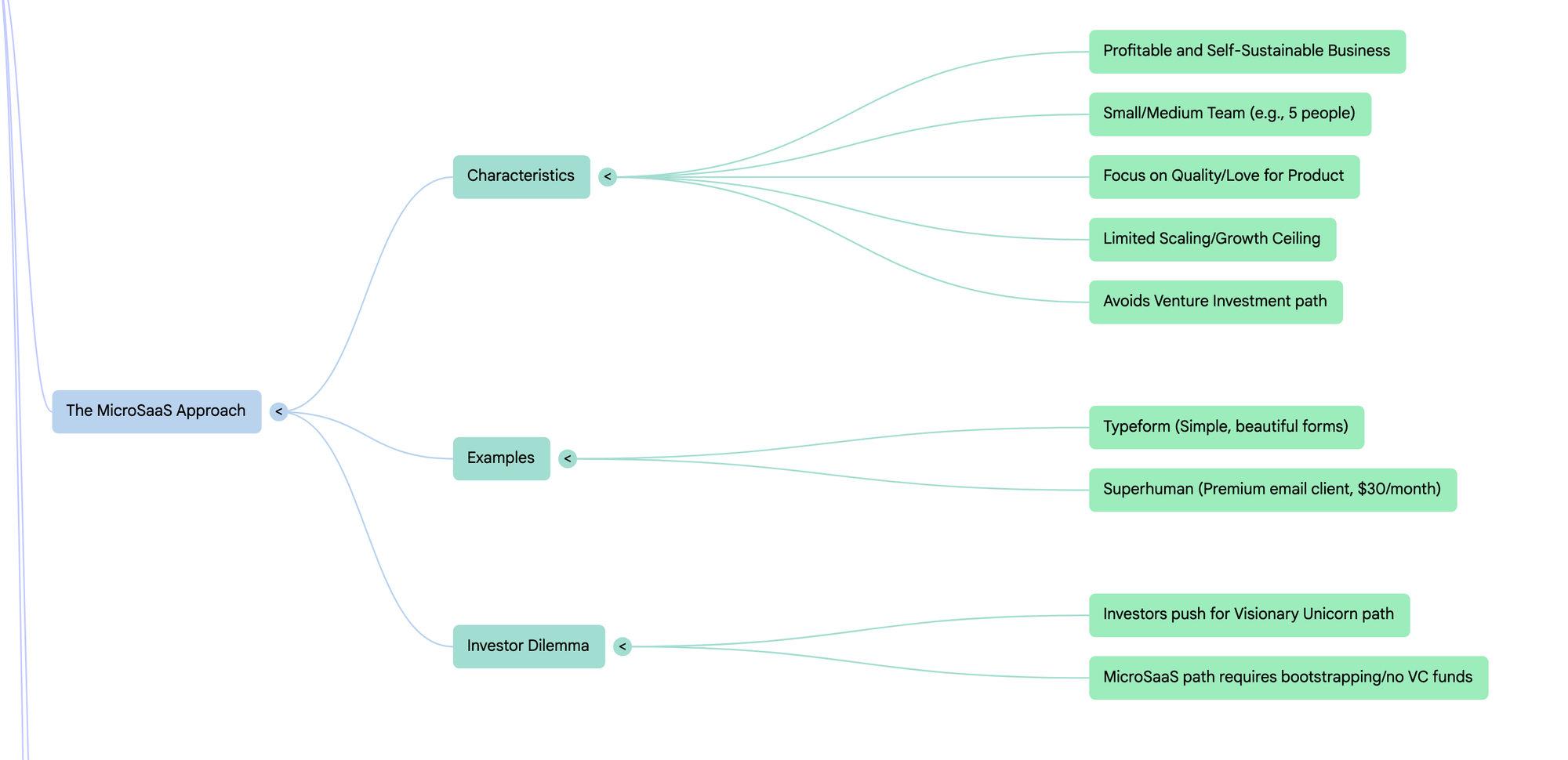

The Profitable Escape: Embracing MicroSaaS

Given the reluctance of early-stage investors, many founders must seriously consider profitability over pursuit of the unicorn dream. This means committing to the MicroSaaS path. This choice acknowledges that the product may hit a "ceiling" and won't grow 10x yearly, but it offers stability and financial control.

This path relies on quality and execution, rather than disruption. Tartach highlights examples of success achieved purely through product excellence in saturated markets:

- Typeform: "Typeform is the simplest product... they just made a MicroSaaS that was very beautiful, and it took off. That's it".

- Superhuman: They entered the age-old email client industry, charging $30 per month just for the UI and features, even though basic email service was provided elsewhere. The success stemmed from the perception that the product was "made with love".

“In principle, any product, if you build it well and with love, people see it, appreciate it, and buy it. But that is MicroSaaS, and that is not a venture story,” Tartach concludes.

The Urgent Need for Self-Identification

For companies like CrossLike, currently in the ambiguous space—too big for MicroSaaS, too small for late-stage venture—the time for decision is now.

“We must answer the question for ourselves first and foremost,” Tartach stresses. The founder must choose:

- Venture Capital Path: Requires a powerful, disruptive, five-to-seven-year Vision that promises 10x returns, necessitating high-risk strategies, and likely, a physical presence in hubs like San Francisco.

- MicroSaaS Path: Requires bootstrapping, eschewing external investment, focusing on revenue generation, and accepting a growth ceiling with a small, high-performing team.

“If we go for venture investment, then we need to sell a powerful vision... If we are simply MicroSaaS, then we build a cozy, great product, and that’s it. And then investment is not necessary,” Tartach concludes. In today’s unforgiving market, clarity is the founder’s most valuable asset.

For founders caught between these two demanding paths, CrossLike.club offers a crucial strategic advantage. Whether pursuing high-risk venture funding or committing to MicroSaaS profitability, both require credibility, attention, and market reach.

CrossLike, as a professional community platform, aims to build a network of real professionals, including founders, C-level managers, top voices, and creators from the US, UK, and Asia. Its core value proposition is to provide members with enhanced engagement on their professional content, such as LinkedIn posts, through strategic, community-driven interactions that leverage platform algorithms to maximize visibility and reach to as many people as possible.

By generating high visibility for valuable content and supporting a founder's personal brand, CrossLike helps founders cut through the "Red Ocean" competition, attracting the attention needed to secure early customers and, eventually, compelling early-stage investors who demand assurance that a venture can achieve significant scale and recognition.

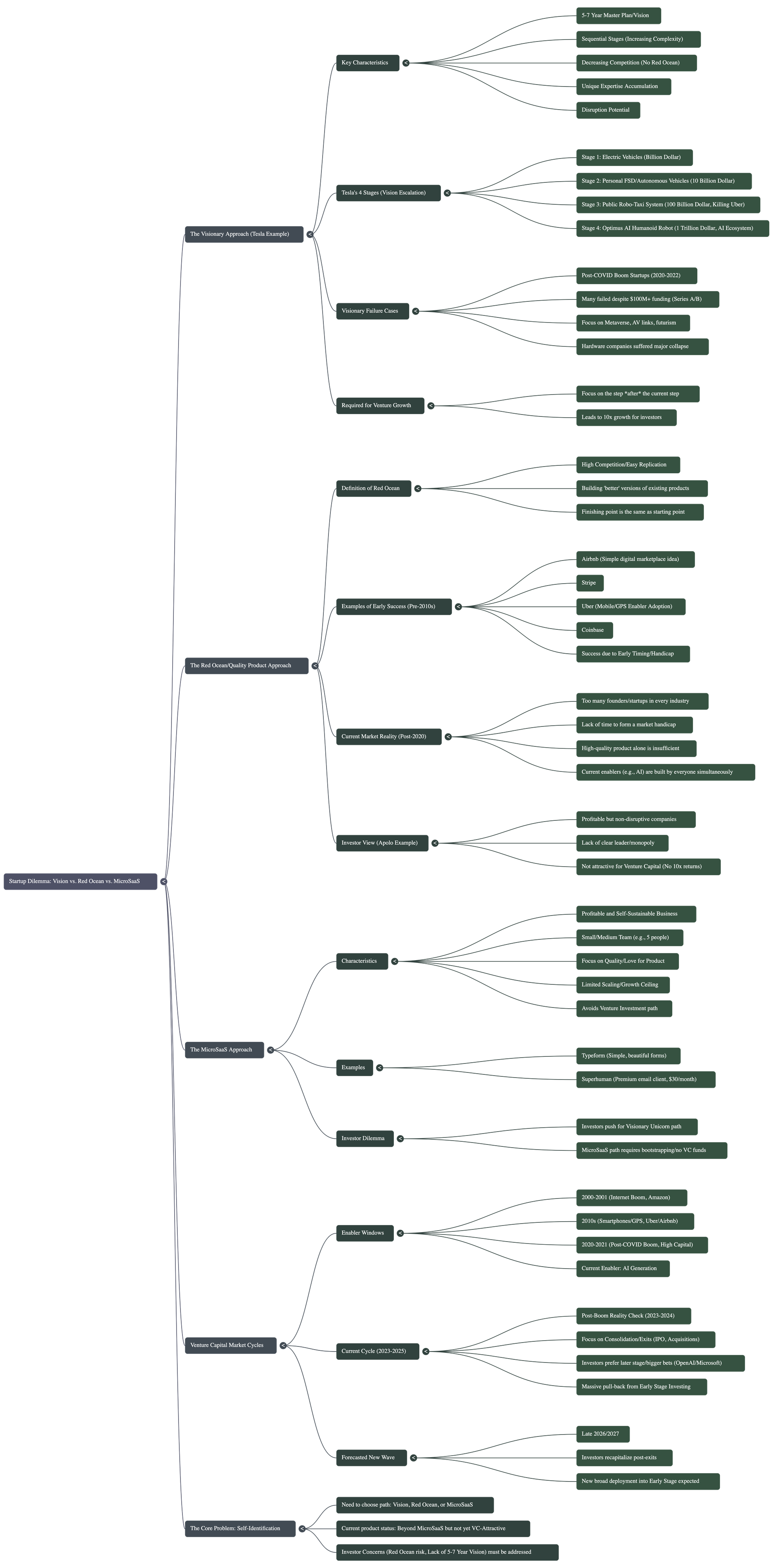

Full mind map: